Get the free state of michigan 1028 form

Show details

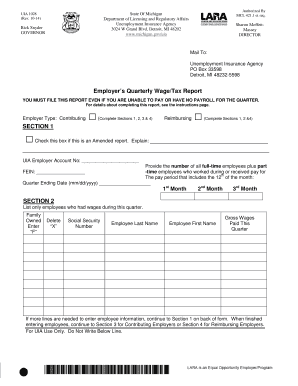

Reset Form 1028 Rev. 11-11 State of Michigan State Tax Commission ANNUAL PROPERTY REPORT For Year Ended December 31 2011 State Assessed Railroads This report is issued under Michigan Public Act 282 of 1905 as amended. Filing of this report is mandatory.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your state of michigan 1028 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of michigan 1028 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit state of michigan 1028 online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit state of michigan 1028. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out state of michigan 1028

01

The state of Michigan 1028 form is typically used by individuals or businesses in Michigan who need to report their Michigan income tax withholding.

02

To fill out the form, start by providing your personal or business information, such as your name, address, and taxpayer identification number.

03

Next, indicate whether you are an individual or business by checking the appropriate box.

04

If you are an individual, provide your Social Security number and indicate your filing status (single, married filing jointly, etc.).

05

If you are a business, provide your Employer Identification Number (EIN) and select your business type (sole proprietorship, partnership, corporation, etc.).

06

On the form, you will find various sections to report your income and deductions. Carefully review the instructions on how to enter the required information for each section.

07

If you had income tax withheld from your wages, report the total amount in the appropriate section. You may need to attach supporting documents such as W-2 forms.

08

Additionally, if you made estimated tax payments throughout the year, provide the total amount paid in the designated section.

09

After completing all relevant sections, double-check your entries for accuracy and completeness.

10

Finally, sign and date the form before submitting it to the appropriate tax authority in Michigan by the due date specified.

Who needs state of Michigan 1028:

01

Individuals who work and have Michigan income tax withheld from their wages.

02

Businesses that have employees and need to report and remit Michigan income tax withholding on their behalf.

03

Any entity that made estimated tax payments to Michigan throughout the year and needs to report these payments for tax purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is state of michigan 1028?

There is no information available about "state of michigan 1028." It could be a typographical error or a reference to something specific that is not widely known or recognized. Please provide more context or clarify your question for further assistance.

Who is required to file state of michigan 1028?

The State of Michigan 1028 form, also known as the Individual Income Tax Return, is required to be filed by individuals who are residents of Michigan and have earned income in the state, or non-residents who have earned income from Michigan sources. Additionally, individuals who have a Michigan tax liability or are claiming a refund must also file this form.

How to fill out state of michigan 1028?

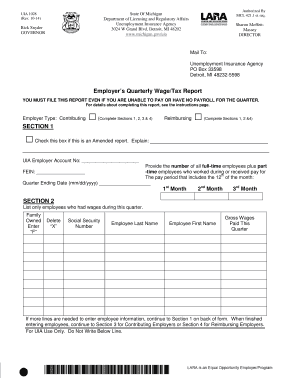

To fill out the State of Michigan 1028 form, which is the Sales, Use, and Withholding Taxes Annual Return, follow the steps below:

1. Obtain the form: You can download the State of Michigan 1028 form from the Michigan Department of Treasury's official website or request a copy to be sent to you.

2. Provide general information: Start by entering the following details at the top of the form:

- Business name

- Tax identification number (EIN, Federal ID, or Social Security Number)

- Business address

- Contact information (phone number, email)

3. Complete the tax liability section: This section requires you to provide information relating to sales/use tax and withholding tax liability for the given tax year. Provide the following information:

- Total sales and use tax collected

- Total sales tax exemption claimed

- Adjustments to sales and use tax

- Total sales and use tax liability (subtract exemptions and adjustments from the total collected tax)

4. Report purchases subject to sales/use tax: Enter the total purchases made during the tax year that are subject to sales/use tax.

5. Report direct pay use tax: If you made any purchases where sales tax was not collected, report the direct payment use tax on those purchases.

6. Report use tax on unreported purchases: If you have purchases that were not subject to sales tax but are subject to Michigan use tax, report the total amount of those purchases.

7. Complete the withholding tax liability section: Provide information related to your withholding tax liability for the tax year, including:

- Withholding tax liability

- Adjustments to withholding tax

- Total withholding tax liability (subtract adjustments from the total withholding tax)

8. Finalize the form: Sign and date the form, write your title or position, and provide your phone number and email if necessary.

9. Attach any additional documentation: If required, attach any supporting documentation, schedules, or other forms to the completed State of Michigan 1028.

10. File the form: Mail the completed form to the designated address provided on the form. Make sure to keep a copy for your records.

It is recommended to familiarize yourself with the form's instructions or consult a tax professional to ensure accurate completion and compliance with any additional requirements.

What is the purpose of state of michigan 1028?

There is no specific "state of Michigan 1028" document or form. It is possible that you are referring to a specific form or document related to the state of Michigan, but without further information, it is not possible to determine its purpose. Please provide more details or context for a more accurate answer.

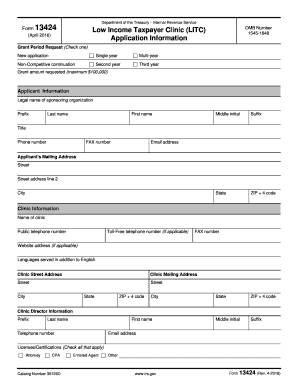

What information must be reported on state of michigan 1028?

The State of Michigan 1028 form is used to report unclaimed property to the Michigan Department of Treasury. The following information must be reported on this form:

1. Holder Information: Details about the organization holding the unclaimed property, including name, address, federal identification number, contact information, and other identifying information.

2. Property Owner Information: Information about the owner of the unclaimed property, including name, address, SSN or taxpayer identification number, date of birth (if available), and any other available identifying information.

3. Description of Property: A detailed description of the unclaimed property being reported, including the type of property (e.g., cash, securities, safe deposit box contents, etc.), any serial numbers or identifying marks, and the estimated value of the property.

4. Property Location: The last known address or location where the unclaimed property was held by the organization.

5. Date of Last Activity: The date of the last activity or contact with the owner of the property.

6. Reporting Period: The time period for which the unclaimed property is being reported (usually a calendar year).

7. Other Supporting Documentation: Any supporting documentation or records related to the unclaimed property, such as transfer and delivery documents, agreements, contracts, or other relevant information.

It is important to note that specific instructions and requirements may vary, and it is recommended to refer to the official Michigan Department of Treasury website or consult a professional for accurate and up-to-date information.

What is the penalty for the late filing of state of michigan 1028?

The specific penalty for the late filing of the Michigan form 1028 may vary depending on the circumstances and the specific rules and regulations of the Michigan Department of Treasury. It is recommended to consult the official guidelines or seek professional advice to get accurate and up-to-date information regarding penalties for late filing.

How can I send state of michigan 1028 for eSignature?

When your state of michigan 1028 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I get state of michigan 1028?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the state of michigan 1028 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I fill out state of michigan 1028 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your state of michigan 1028, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your state of michigan 1028 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.